social security tax limit 2021

More than 44000 up to 85 percent of your benefits may be taxable. Your adjusted gross income.

2021 Social Security Earnings Limit Youtube Social Security Social Financial Decisions

For the 2021 tax year single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits.

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

. 62 Social Security tax on the first 142800 of wages maximum tax is 885360 62 of 142800 plus. Filing single single head of household. This means that you will not be required to pay any additional Social Security taxes beyond this amount.

This is the largest increase in a decade and could mean a higher tax bill for some high earners. Most people need 40 credits to qualify for retirement benefits. IRS Tax Tip 2021-66 May 12 2021 Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits.

Or Publication 51 for agricultural employers. The tax rate for Social Security tax is 62 Both the employee and employer must pay this percentage so the SSA will receive a total of 124 of your wages. If that total is more than 32000 then part of their Social Security may be taxable.

Up to 50 percent of your benefits if your income is 25000 to 34000 for an individual or 32000 to 44000 for a married couple filing jointly. If you earned more than the maximum in any year whether in one job or more than one we only use the maximum to calculate your benefits. A Amount of Social Security or Railroad Retirement Benefits.

The rate consists of two parts. For 2021 an employee will pay. The self-employment tax rate is 153.

If you are an entrepreneur you will pay double or 1770720 per year as you will be responsible for employer and employee taxes. As its name suggests the Social Security self-employed. When you work you earn credits toward Social Security benefits.

If your combined income was more than 34000 you. What is the Social Security cap for 2021. If you file as an individual with a total income thats less than 25000 you wont have to pay taxes on your Social Security benefits in 2021 according to the Social Security Administration.

Social Security Tax Limit for 2021. The OASDI tax rate for wages paid in 2022 is set by statute at 62 percent for employees and employers each. The maximum earnings that are taxed have changed over the years as shown in the chart below.

When you have more than one job in a year each of your employers must withhold Social Security taxes from your wages. Up to 85 percent of your benefits if your income is. The Social Security tax limit in 2021 is 885360.

In addition your future benefit amount will not. You can earn a maximum of four credits each year. Tax Rate 2020 2021 Employee.

Youll be taxed on. Other important 2021 Social Security information is as follows. For earnings in 2022 this base is 147000.

For 2021 the maximum taxable earnings limit is 142800. Anything you earn over that annual limit will not be subject to Social Security taxes. For earnings in 2022 this base is 147000.

If an employees 2021 wages salaries etc. Your employer will pay an additional 885360 per year. What is the income limit before Social Security is taxed.

Fifty percent of a taxpayers benefits may be taxable if they are. The employers Social Security payroll tax rate for 2021 January 1 through December 31 2021 is the same as the employees Social Security payroll tax. 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance.

Thats what you will pay if you earn 147000 or more. 62 of each employees first 142800 of wages salaries etc. Thus an individual with wages equal to or larger than 147000 would contribute 911400 to the OASDI.

Earnings above this amount are not subject to Social Security tax or factored into Social Security payments in. In 2021 the Social Security tax limit is 142800 and in 2022 this amount is 147000. Each year the federal government sets a limit on the amount of earnings subject to Social Security tax.

Exceed 142800 the amount in excess of 142800 is not subject to the Social Security tax. In 2021 the Social Security taxable maximum is 142800. For 2021 the first 142800 of your combined wages tips and net earnings is subject to any combination of the Social Security part of self-employment tax.

We call this annual limit the contribution and benefit base. B One-half of amount on line A. Are married and file a separate tax return you probably will pay taxes on your benefits.

145 Medicare tax on the first 200000 of wages 250000 for joint returns. The wage base limit is the maximum wage thats subject to the tax for that year. C Taxable pensions wages interest dividends and other.

In 2021 however that cap will rise to 142800 meaning higher earners will part with more of their money to help fund Social Security. The number of credits you need to be eligible for Social Security benefits depends on your age and the type of benefit for which you are applying. Between 32000 and 44000 you may have to pay income tax on up to 50 percent of your benefits.

This amount is also commonly referred to as the taxable maximum. Hunter Kuffel CEPF Dec 28 2021. Only the social security tax has a wage base limit.

How is Social Security taxed 2021. D Tax-exempt interest plus any exclusions from income. In 2021 the Social Security tax limit is 142800 up from 137700 in 2020.

The most you will have to pay in Social Security taxes for 2021 will be 9114. 125000 for married taxpayers filing a. In 2021 the Social Security tax limit is 142800 and in 2022 this amount is 147000.

Refer to Whats New in Publication 15 for the current wage limit for social security wages. If you earn 142800 in 2021 the maximum amount you will pay in Social Security taxes is 62 of your income or 885360. The maximum amount of Social Security tax an employee will pay in 2021 is 885360.

How Social Security taxes on income work. Worksheet to Determine if Benefits May Be Taxable. Quarter of 2019 through the third quarter of 2020 Social Security and Supplemental Security Income SSI beneficiaries will receive a 13 percent COLA for 2021.

For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security.

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

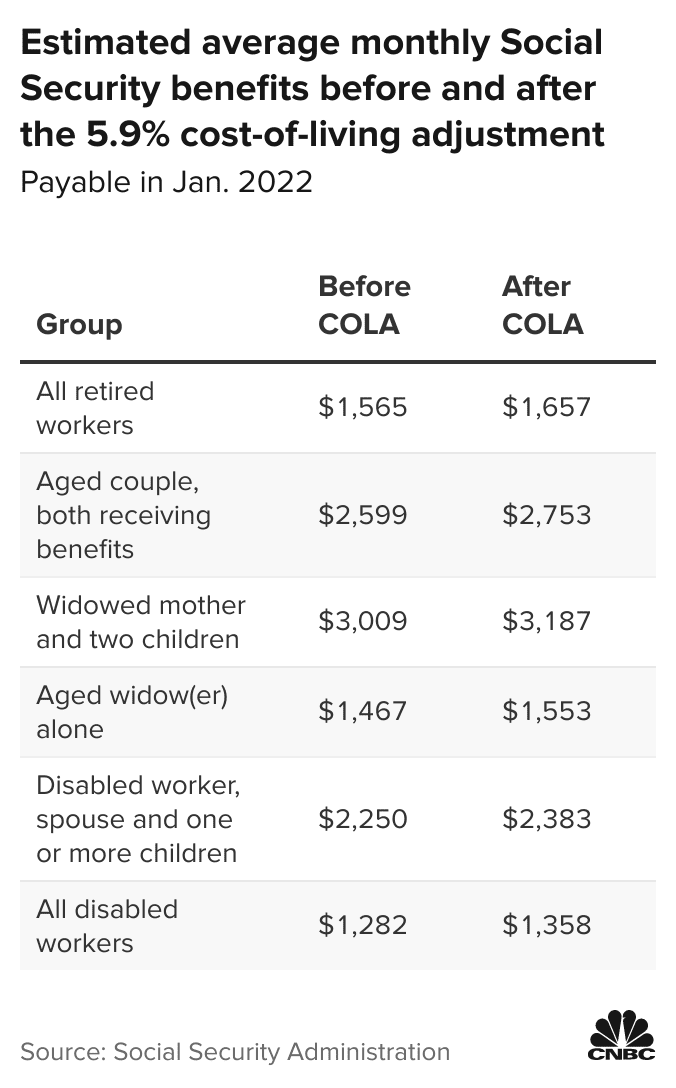

Social Security Cost Of Living Adjustment Will Be 5 9 In 2022 Biggest Annual Hike In 40 Years

Social Security Will Be Insolvent By 2033 The Washington Post

Social Security Cost Of Living Adjustment Will Be 5 9 In 2022 Biggest Annual Hike In 40 Years

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

What To Do When Excess Social Security Tax Is Withheld Stanfield O Dell Tulsa Cpa Firm

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

The Social Security Wage Base Is Increasing In 2022 Sensiba San Filippo

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Payroll Accounting 2020 30th Edition Solutions Manual By Bieg Payroll Accounting Payroll Accounting

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Do You Have To Pay Tax On Your Social Security Benefits Youtube

Social Security Washington Leaders At Odds Over Proposed Tax Increases

2022 Wage Cap Jumps To 147 000 For Social Security Payroll Taxes

Have You Ever Wondered How The Tfsa Contribution Limits Work What Investment Options Are Available To You What Money Sense Investing Money Personal Finance

/GettyImages-1134937342-4f983d6e2462466b902206a0525d82b3.jpg)